Financial Issues Top DOHA Clearance Denials in 2020

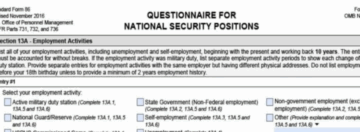

Out of ninety-three security clearance appeal decisions made by the Defense Office of Hearing and Appeals (DOHA) so far in 2020, sixty-eight of them involved financial issues. Failure to file or pay Federal and state taxes, delinquent credit cards accounts, collections, and a historical pattern of irresponsibility continue to plague applicants and their ability to obtain a clearance. Personal conduct issues ranked second highest and usually involved a lack of candor in omitting information or being untruthful on the investigative paperwork. In one particular appeals case the applicant claimed his six Federal tax liens, two state tax liens, and nine delinquent accounts totaling around $10,000 in debt weren’t listed on the SF-86 because he was not aware of them. Needless to say, the DOHA judge wasn’t impressed with his credibility and upheld the clearance denial.

It still amazes me how many security clearance applicants don’t do the research to find out what could cause a security clearance denial, nor do many take actions to mitigate possible concerns before applying for a job requiring a security clearance. With all the information out there online (especially on this blog site) ignorance is no excuse. The Adjudicative Desk Reference provides all applicants need to identify and address potential concerns. Most financial issues can be mitigated by taking proactive measures and getting a plan in place to show you are responsibly addressing your legal debts. In most appeals cases it is not the debt itself that causes the clearance denial, but rather the lack of action taken to address it.

I suspect that the majority of online checks conducted as part of “Continuous Evaluation” will focus on financial issues, if only because they are probably the easiest to discover. I suspect that a bad credit score will be easier to discover than an arrest record… or at least it will be reported to all the credit agencies sooner than criminal history databases are updated.

I think they notice what’s on your credit report, not your score. If you’re asked, you better have a good answer. I went through financial issues after my divorce, like most people. If you can accurately document what the cause is and that you’re actively doing something about it, you’ll go a long way toward proving viability.

I think you are correct about that but in the new era of CE, would any issues on the credit report trigger an investigation? A suspension? I’m talking about someone who is already cleared who has been enrolled in Continuous Evaluation, not someone being investigated for the first time.

Yes . . . I think that this is exactly the point of CE.

There are specific events for each tier level that would lead to CE Subject interview. Credit score is not one of them. Unreported bankruptcy, court actions, liens, collections, and delinquencies (over 120 days) would probably be CE events.